Can Small Businesses Claim VAT Back? Your VAT Reclaim Guide for 2025

As a small business owner, every pound counts. You're likely all too familiar with charging VAT to your customers, but a common question we hear is: "Can small businesses claim VAT back?"

The quick answer is yes, if your business is VAT-registered, you can typically reclaim the VAT paid on goods and services you buy for your business. This process, known as input VAT recovery, can significantly improve your cash flow and reduce your overall business costs.

This guide will walk you through exactly what you can claim, how to do it, and the common pitfalls to avoid in 2025.

What VAT Can Small Businesses Reclaim?

You can reclaim the VAT on most purchases that are used exclusively for your business. This is called "input tax." To be eligible, you must have a valid VAT invoice from your supplier.

Here are common examples of business purchases where you can claim VAT back:

-

Office Supplies: Stationery, printer ink, and postage costs.

-

Equipment: Computers, printers, machinery, and tools used for the business.

-

Stock & Materials: Goods you buy to sell on or use in your products.

-

Business Software: Accounting software, project management tools, and subscriptions.

-

Vehicle Costs: Only for vehicles used exclusively for business. (We'll cover mixed-use below).

-

Travel Expenses: Hotel rooms and train fares for business trips (but not usually meals).

-

Professional Services: Accountancy fees, legal fees, and consultancy costs.

-

Rent & Utilities: For your business premises, like an office or workshop.

Crucial Point: You must hold a valid VAT invoice to support any claim. A simple receipt or bank statement is not enough for HMRC.

The VAT Reclaim Process: How to Claim VAT Back

The standard way to reclaim VAT is through your regular VAT Return, which you submit to HMRC (usually quarterly).

Here’s a simple step-by-step guide to the VAT reclaim process:

-

Register for VAT: You must be officially VAT-registered with HMRC to make a claim.

-

Keep Valid VAT Invoices: For every business purchase, obtain and file a VAT invoice showing the supplier's details, your details, the VAT number, and the amount of VAT charged.

-

Record in Your Accounts: Log the VAT from these invoices into your bookkeeping or accounting software as "input VAT" or "VAT on purchases."

-

Complete Your VAT Return: On your VAT Return form (typically online), you will enter:

-

Box 1: The VAT you've charged your customers (output VAT).

-

Box 4: The VAT you've paid on your business purchases (input VAT).

-

-

Submit and Pay/Receive: HMRC calculates the difference. If the VAT in Box 4 is greater than in Box 1, you will receive a refund from HMRC.

Common VAT Reclaim Mistakes to Avoid

Many small business claims are delayed or rejected due to simple, avoidable errors. Steer clear of these common mistakes:

-

Claiming Without a VAT Invoice: This is the number one reason for rejected claims. Ensure every claim is backed by a full VAT invoice.

-

Claiming on Exempt or Disallowed Items: You cannot reclaim VAT on things like:

-

Business entertainment (e.g., taking a client to lunch).

-

Goods or services used for non-business purposes.

-

Assets bought before your business was VAT-registered (with some exceptions under the VAT registration rules).

-

-

Incorrectly Claiming on Cars: Generally, you cannot reclaim the VAT on a car unless it is used exclusively for business (e.g., a driving school car or a pool car with very specific rules).

-

Poor Record Keeping: HMRC can ask to see your records for up to 6 years. Disorganised records can lead to problems during an inspection.

The Tricky Part: Reclaiming VAT on Mixed-Use Items

Some items are used for both business and personal purposes. The rules for input VAT recovery here are strict.

-

The Rule: You can only reclaim the VAT on the business proportion of the cost.

-

Example - Mobile Phone: If you use your phone 60% for business and 40% personally, you can only reclaim 60% of the VAT paid on the handset and the monthly bill.

-

Example - Home Office: If you work from home, you may be able to reclaim a proportion of the VAT on your utilities based on the number of rooms used for business and the amount of time they are used.

You must be able to justify the business percentage with a fair and reasonable method.

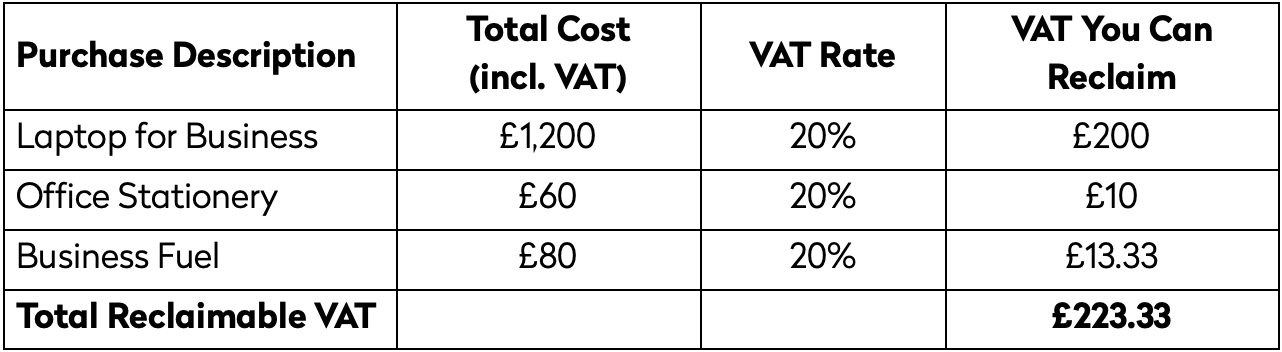

VAT Reclaim Calculation

To make estimating your potential VAT refund easier, use our simple calculator below.

*Formula: Total Cost ÷ (1 + VAT Rate as a decimal) = Net Cost. Then, Total Cost - Net Cost = Reclaimable VAT.*

*Example for £80 Fuel: £80 ÷ 1.2 = £66.67 (Net). £80 - £66.67 = £13.33 (VAT).*

Ready to Reclaim?

Understanding how to claim VAT back is a powerful financial tool for any VAT-registered small business. By keeping accurate records, knowing what you can claim, and avoiding common errors, you can ensure you're not missing out on valuable cash flow.

.png)

.png)